Why choose Super Credit?

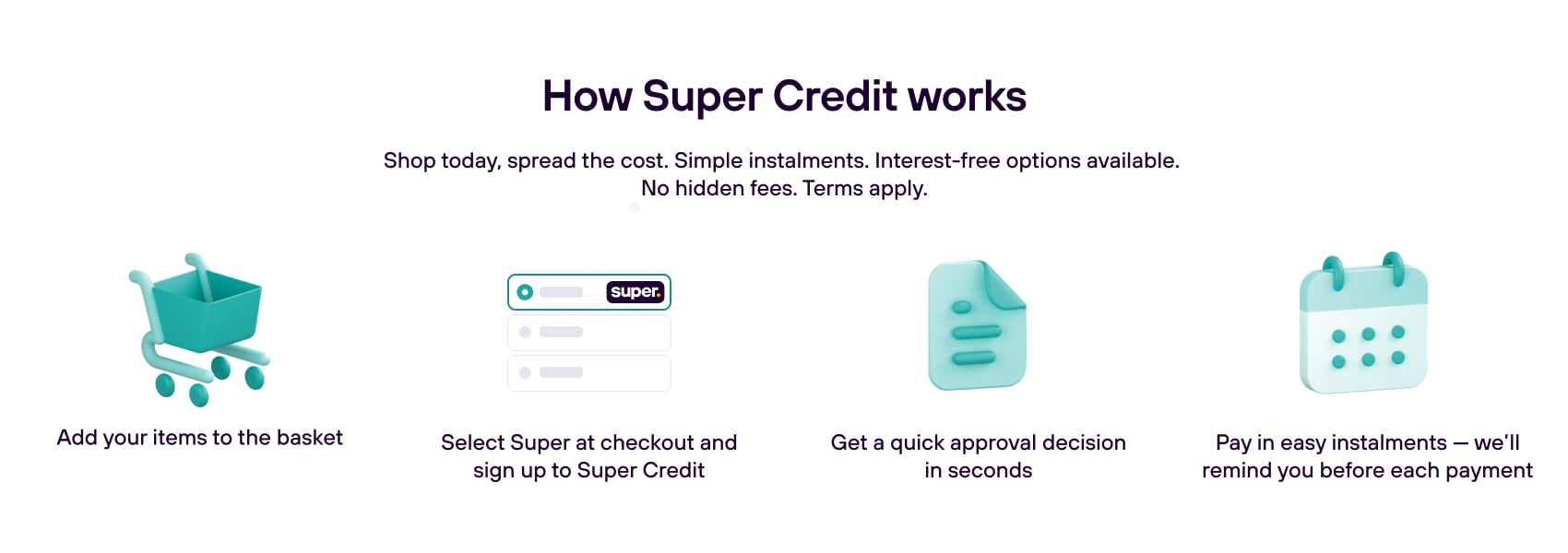

- Flexible – split your payments into manageable instalments.

- Transparent – know exactly what and when you’ll pay, upfront.

- Fast – quick approval, no lengthy forms.

- Secure – Super Credit is powered by Abound, a regulated provider.

FAQs

- What do I need to start my application? Applicants must have a UK bank account, be 18 years of age or over and a UK residential address.

- Will using Super Credit affect my credit score? A ‘soft credit check’ happens when we check eligibility. This doesn’t affect your credit score, or your chances of using credit in the future. If you are approved and choose to spread the cost over a longer period of time, a full credit check will be completed prior the purchase being completed.

- How do I make a repayment? You can manage repayments via the Super Payments app.

Important information regarding Super Credit

Super Credit is provided by Abound (see below) and is subject to status. Super is not a lender. Terms apply.

Fintern Ltd, trading as Abound, is registered in England & Wales No. 12472034 and is authorised and regulated by the Financial Conduct Authority, FRN 929244. Fintern Ltd, 3rd Floor, 86-90 Paul Street, London, EC2A 4NE.

Super Payments Limited, trading as Super and Super Payments, is an Introducer Appointed Representative (FRN 1034245) of Abound and may receive commission for introductions.

Missed payments may affect your credit score and you will incur late payment fees and additional interest. Missing payments will remove any promotional 0% rates from your instalment plans.